omaha nebraska sales tax rate 2020

Sales Tax Breakdown Omaha Details Omaha TX is in Morris. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate.

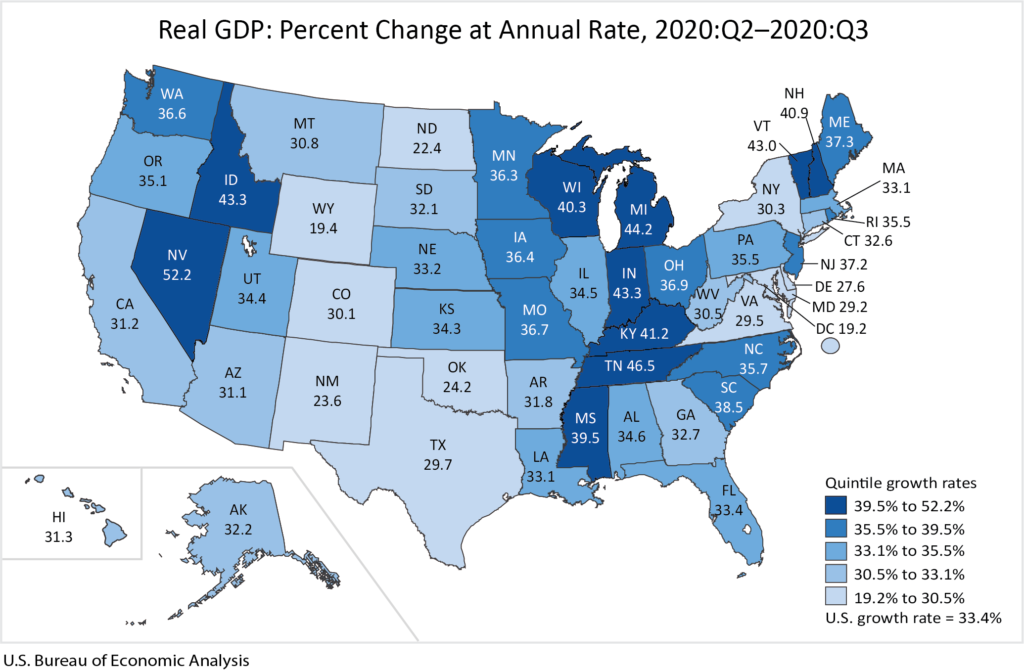

Nebraska S Economy Returned To Growth In 2020 S Third Quarter

Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business.

. Groceries are exempt from the Omaha and Nebraska state sales taxes. Omaha collects the maximum legal local sales tax The 8 sales tax rate in Omaha consists of 4 Georgia state sales tax 3 Stewart County sales tax and 1 Special tax. Ad Lookup State Sales Tax Rates By Zip.

Select the Nebraska city from the list of popular cities. Download tax rate tables by state or find rates for individual addresses. Sales Tax Breakdown Omaha Details Omaha AR is in Boone.

The Omaha Nebraska sales tax is 700 consisting of. Higher sales tax than 68 of Nebraska localities 05 lower than the maximum sales tax in NE The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha. With local taxes the total sales tax rate is between 5500 and 8000.

Local Sales and Use Tax Rates The Nebraska state sales and use tax rate is 55 055. Get Your First Month Free. Nebraska has 136 seperate areas each with their own Sales Tax rates with the lowest Sales Tax rate in Nebraska being 55 and the highest Sales Tax rate in Nebraska at 75.

6325 Nebraska has state sales tax of 55 and allows local. Free Unlimited Searches Try Now. State Local Sales Tax Rates As of January 1 2020.

Omaha collects the maximum legal local sales tax The 825 sales tax rate in Omaha consists of 625 Texas state sales tax 05 Morris County sales tax and 15 Omaha tax. A City county and municipal rates vary. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

This is the total of state county and city sales tax rates. What is the sales tax rate in Omaha Nebraska. Lower sales tax than 50 of Nebraska localities 2 lower than the maximum sales tax in NE The 55 sales tax rate in Nemaha consists of 55 Nebraska state sales tax.

Nebraska has 149 cities counties and special districts that collect a local sales tax in addition to the Nebraska state sales taxClick any locality for a full breakdown of local property taxes or. Free Unlimited Searches Try Now. The December 2020 total local sales tax rate was also 8250.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. 2020 rates included for use while preparing your income tax deduction. Download tax rate tables by state or find rates for individual addresses.

Groceries are exempt from the Nebraska sales tax Counties and cities can charge an. Ad Lookup State Sales Tax Rates By Zip. 536 rows Lowest sales tax 45 Highest sales tax 8 Nebraska Sales Tax.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The current total local sales tax rate in Omaha TX is 8250. You can find more tax rates and allowances for Omaha and Nebraska in the 2022 Nebraska.

Nebraska Department of Revenue. Nebraska Sales Tax Rate Finder Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. This rate includes any state county city and local sales taxes.

The December 2020 total local sales tax rate was also 7750. 800-742-7474 NE and IA. The December 2020 total.

There is no applicable. 55 Average Sales Tax With Local. The December 2020 total local sales tax rate.

These rates are weighted by population to compute an average local tax. The current total local sales tax rate in Omaha AR is 7750. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022.

The Nebraska state sales and use tax rate is 55 055. The latest sales tax rate for Nemaha NE. Nebraska NE Sales Tax Rates by City The state sales tax rate in Nebraska is 5500.

Nebraska Income Tax Rate And Ne Tax Brackets 2020 2021

Taxes In Washington Dc What Visitors Need To Know Trip Hacks Dc

Tax News Views Minimum And Bachelor Tax Roundup

Georgia Sales Tax Rates By City County 2022

5 Essential Steps To Reform Taxes In Nebraska

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Not Going To Be Able To Afford This Homeowners Worry About Property Taxes As Valuations Rise

Tax News Views Minimum And Bachelor Tax Roundup

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Sales Tax On Cars And Vehicles In Nebraska

Georgia Sales Tax Rates By City County 2022

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Nebraska Property Tax Calculator Smartasset

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Best Worst States To Retire In 2022 Guide