non filing of income tax return

2 days agoThe IRS says people who werent required to file 2021 tax returns are typically individuals earning less than 12500 or married couples who earned less than 25000 last. Similar to TDS if a person has non filed.

Affidavit Of Non Filing Of Income Tax Pdf Affidavit Payments

A person who fails to file return within.

. For late filing of Tax Returns with Tax Due to be paid the following penalties will be imposed upon filing in addition to the tax due. The failure-to-file penalty grows every month at a set rate. A new penal regime for non-filing of income tax return has been introduced through amendment in section 182 of the Ordinance.

An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. Return of Income The best income tax lawyers in Karachi and Islamabad are here to help you file your FBR income taxes on time and avoid becoming an income tax non-filer. Premium federal filing is 100 free with no upgrades for premium taxes.

Flores the Supreme Court agreed with its investigating officer that evasion of income tax is a crime involving moral turpitude. PENALTIES FOR LATE FILING OF TAX RETURNS. Many people may lose out on their tax refund simply because they did not file a federal income tax return.

Make an appointment at your local taxpayer assistance. For possible tax evasion exceeding Rs25 lakhs. The penalty wont exceed 25 of your unpaid taxes.

Penalty for not filing ITR plus imprisonment of at least 6 months which can extend to 7 years. If you owe taxes and fail to pay them you. Basically it is a statement that the deducers who have not been liable to deduct a tax or deducted a tax for any quarter within the quarter and who subsequently have not filed any TDS statement.

The Failure to File Penalty is 5 of the unpaid taxes for each month or part of a month that a tax return is late. The minimum penalty for failing to file within 60 days of the due date 210 or 100 percent of your unpaid taxes whichever is less. In the 1979 case of Zari v.

The types of taxes a deceased taxpayers estate. The Comelec does not say that failure to file an. Belated return under section 139 4 for the financial year 2021-22 can be filed at any time before the expiry of one year from the end of the relevant assessment year AY 2022.

By law they only have a three-year window from the original due. Not filing your return on time can have negative consequences ranging from delaying your refund to civil and criminal penalties. Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100.

At the applicable rate in force as prescribed in the Finance Act. Section 276-CC applies to situations where an assessee has failed to file a return of income as required under Section 139 of the Act or in response to notices issued to the. Since failure to pay.

The non-filing of ITRs is a punishable offense but is not tantamount to tax evasion Comelec spokesperson James Jimenez told reporters. Twice the rate stated in the relevant Income Tax Act provisions. Mailing in a form.

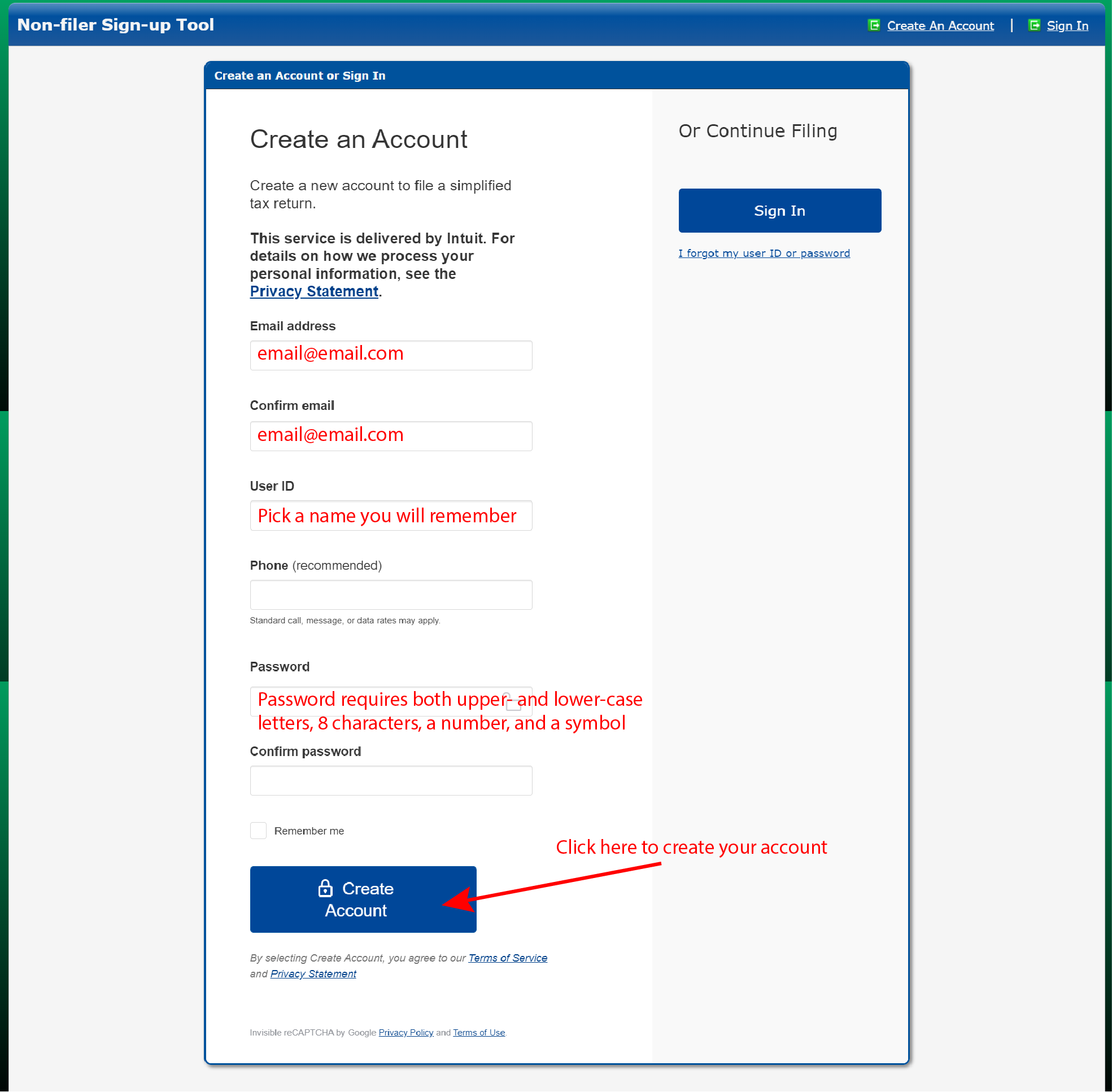

Ad Prep File Your Own Taxes with Fast User-Friendly Software 100 Free. Order copies of tax records including transcripts of past tax returns tax account information wage and income statements and verification of non-filing letters. Non Tax filers can request an IRS Verification of nonfiling free of charge from the IRS in one of three ways.

How To Fill Out The Irs Non Filer Form Get It Back

Penalty For Non Filing Of Annual Income Tax Returns 2021 Budget

Non Filing Of Us Income Tax Return 2011 2012 Academic

Consequences Of Non Filing Of The Income Tax Return Avs Associates

Congress Again Considers Free Irs Income Tax Filing System Cpa Practice Advisor

How To File A Zero Income Tax Return 11 Steps With Pictures

How To File A Zero Income Tax Return 11 Steps With Pictures

What Happens If Itr Is Not Filed What Are The Consequences

How To Fill Out The Irs Non Filer Form Get It Back

Faq Internal Revenue Service Irs How Can I Complete The Verification Of Non Filing

Accurals Accounting Management Solutions Taxpayers Who Do Not File Their Income Tax Return On Time Can Be Subject To Penalty And Charged An Interest On The Late Payment Of Income

How To Respond To Non Filing Of Income Tax Return Notice

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

Penalties For Non Filing Of Income Tax Returns Wealth Statements Foreign Assets Income Tax Return Income Tax Income Statement

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

Affidavit Of Non Filing Of Income Tax Pdf Affidavit Payments

Income Tax Non Filing Letters From Rita Mailing This Week City Of Mentor Ohio

Stimulus Payments Non Filers Social Security Should You File